USDA Mortgage

The USDA mortgage loan program offers rural homebuyers and homeowners the opportunity to obtain a mortgage without the restrictions of other mortgage programs that might make it impossible to buy or refinance a rural home.

What Is The USDA Mortgage Program?

The United States Department of Agriculture (USDA) home mortgage program, also known as the USDA Rural Development Guaranteed Housing Loan Program, was created in 1949 to assist low—to moderate-income homebuyers in rural America in purchasing homes. The program aims to stimulate economic development and improve the quality of life in rural communities.

The USDA home loan program in California is a government-backed mortgage offered by private home loan lenders and guaranteed by the USDA. It allows borrowers to purchase a home without a down payment and offers low interest rates.

USDA Mortgage Benefits

Property Eligibility: Having a dedicated mortgage program for rural properties is a significant benefit. It allows the lender to focus on communities that might otherwise not obtain financing.

No Down Payment: The biggest benefit to the USDA mortgage program is that you don’t need to provide a down payment to get approved. That is a huge benefit that most other mortgage programs don’t have!

No Pre-Payment Penalty: If you want to refinance or pay off your USDA mortgage early, not a problem. There is no pre-payment penalty.

Get The Right USDA Mortgage

We’re the ideal partner for obtaining a USDA mortgage. We offer mortgage rates below the national average, fast closings, and exceptional service. We’re partnered with the best organizations in the industry to ensure your satisfaction. Hit the “Get Started” button at the top of the page, and get pre-approved today.

USDA Mortgage Requirements

Here are the six main requirements for the USDA mortgage program for rural homebuyers and homeowners.

Credit

The minimum credit score requirement for the USDA mortgage program is a 640. Ideally though, you want a credit score above 680 and underwriters take your middle credit score.

Income

Ideally, you’ll want a Debt-To-Income ratio (DTI) at or below 38% to meet the programs income requirements. Underwriting can increase to a DTI on a case by case basis.

Equity

No down payment is required when using the USDA mortgage program to purchase an eligible property. And the property must be in a rural designated zip code.

Appraisal

You will be required to do an appraisal when you access the USDA mortgage program. While the lender orders the appraisal, the homebuyer pays for it and the appraiser is independent of the transaction.

Asset

You generally do not need to provide liquid asset documentation showing cash reserves when applying for a USDA mortgage with the exception of documenting the source of your down payment.

Documentation

When applying for a USDA mortgage, plan on providing two years of income documentation in addition to the standard mortgage documentation associated with a purchase or refinance.

Five Steps To The USDA Mortgage Application Process

Applying for a USDA mortgage is similar to other mortgage programs. Working with a top-rated mortgage company and a loan officer with more than five years of experience will help ensure a smooth and efficient loan process.

- Locate and contact a lender who offers the USDA home loan in California. The home loan lender will review your financial situation and help determine your eligibility for a USDA mortgage.

- The next step is to complete a loan application with your loan officer. The loan officer will provide a loan application that must be completed and returned with all required documents, including income documentation, employment information, and credit history (the lender will obtain a credit report).

- The property you are buying or refinancing must be appraised. The home loan lender will arrange for an appraiser to evaluate the property to determine its current market value.

- USDA mortgages require mortgage insurance (like an FHA mortgage insurance), which protects the lender if the borrower defaults on the loan. All USDA mortgages have mortgage insurance.

- Once the underwriter has approved your application and you have met all the underwriting requirements, you can close your loan!

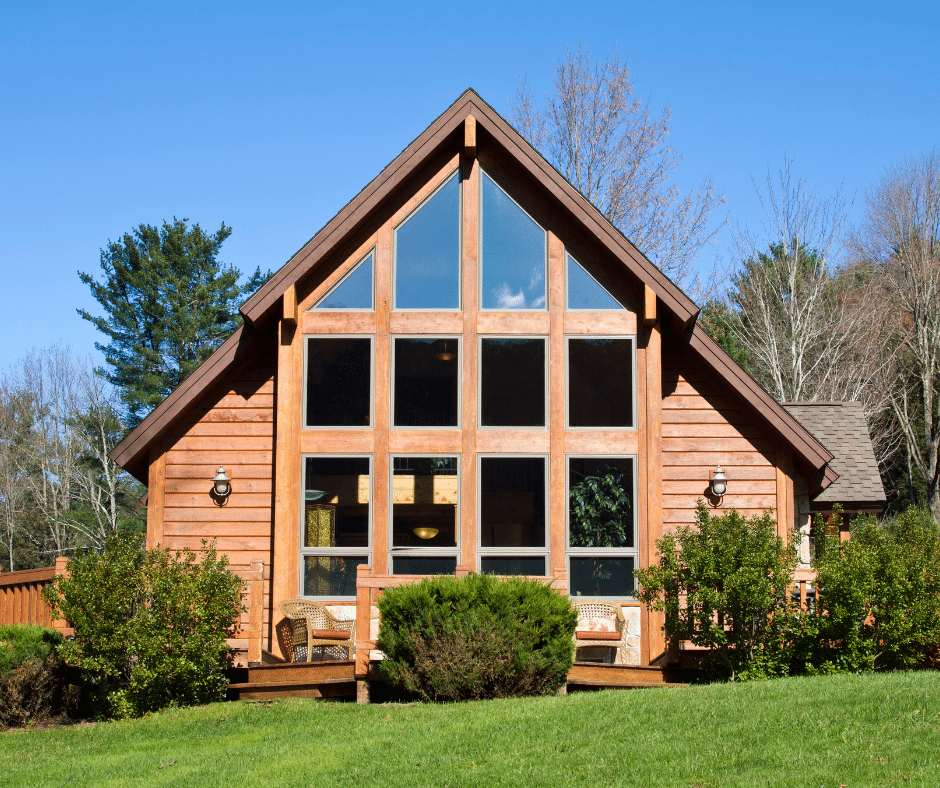

The five steps to the USDA mortgage application are relatively simple. Here is a mortgage pro tip for loan applicants refinancing their mortgage into a new USDA mortgage: before the appraiser arrives at your home to complete the appraisal inspection, make sure the house is ready to show.

“Ready to show” means treating the appraisal inspection like you were selling the home. Clean all the rooms and attend to any necessary landscape concerns. A house that looks ready to sell is in a better position to obtain the most value in an appraisal report.

USDA Mortgage FAQs

I Need a Zero-Down Mortgage Program, and I Live In A Big City. Can I Get a USDA Mortgage?

No, the USDA mortgage is strictly reserved for those looking to buy a home in a rural zip code.

Does The USDA Mortgage Program Have Income Eligibility Requirements?

Yes, it does, and they are based on household size and property location. These USDA mortgage income limits are updated annually and adjusted for inflation.

Are Farms Eligible For The USDA Mortgage Program?

No, the program is strictly for residential homes in rural communities.

Explore Some Of Our Other Mortgage Programs

Conventional

A conventional mortgage is the most common mortgage program. Fannie Mae and Freddie Mac set the base guidelines.

FHA

FHA is a powerful program for those with less-than-perfect credit and a low down payment (or little equity).