Redefining the California Mortgage Experience

Low Rates, Fast Closings, and Exceptional Service

Work directly with Loan Officer Kevin O’Connor, a California mortgage expert with over 20 years of mortgage experience, helping homeowners refinance and purchase properties throughout California.

California mortgage strategies: Purchase, refinance, cash-out refinance, conventional, FHA, VA, jumbo loans, and more.

Kevin’s unique, clear-to-close method and underwriting optimization will simplify and streamline the entire process.

You’ll have 24/7 access to your dedicated online portal, where you can apply, upload documents, and receive notices.

In association with JB Mortgage Capital, Inc., a California mortgage broker, Kevin is licensed by the California Department of Real Estate and the Nationwide Mortgage Licensing System.

“Kevin is a true professional! He assisted my family with our mortgage when we bought our house and multiple refinances as well. He is knowledgeable, professional, and treats me like I’m his most important client.”

“I highly recommend Kevin O’Connor. Excellent service, hard work, always available, and willing to patiently walk us through all of the complexities of buying a home……. Kevin was up front and transparent about what to expect with closing costs and our monthly payment.”

“Kevin is incredible. We’ve done several mortgages with him, and he is always extremely informative. Kevin is professional, courteous, and very knowledgeable, and after working with him many times over the years, we certainly trust his judgment, insight, and advice.”

California Mortgage Options

Not every mortgage is built the same. Start by understanding the structure that fits your situation.

Buying or refinancing a home in California isn’t one-size-fits-all.

A smart mortgage strategy considers credit profile, debt-to-income ratio, loan-to-value ratio, short and long-term goals, property variables, and underwriting guidelines, not just the interest rate.

Strategy, Speed & Execution

Mortgage Strategy Planning: Kevin helps you choose the right loan structure upfront. Balancing monthly payment, long-term cost, equity growth, and future flexibility.

Low Rates: Through trusted lending partners, Kevin provides access to highly competitive rates for purchase, refinance, and cash-out refinance transactions.

Clear-To-Close: Kevin’s unique clear-to-close workflow will streamline your process and help you close your loan faster.

Underwriting Optimization: Your loan is structured and submitted in the way an underwriter evaluates it. Fewer conditions. Fewer delays. Cleaner approvals.

Fast response • No pressure • California focused

Helping Homeowners Achieve Their Dreams

Whether you are purchasing your first home, upgrading, investing, or restructuring debt, the right mortgage strategy can save you time and money.

Loan Officer Kevin O’Connor works with a wide range of borrower profiles and scenarios, and he’s focused on getting you a mortgage that aligns with your financial goals, not just today, but long term.

Kevin works with:

- First-time buyers navigating the California mortgage market

- Move-up buyers upgrading strategically

- Self-employed borrowers with complex income

- Credit-rebuilding scenarios needing structured approvals

- Homeowners lowering payments or removing mortgage insurance

- Property owners accessing equity for renovations or debt consolidation

Kevin’s underwriting optimization and clear-to-close process is direct, transparent, and built around fast, clean approvals, so you can move forward with confidence.

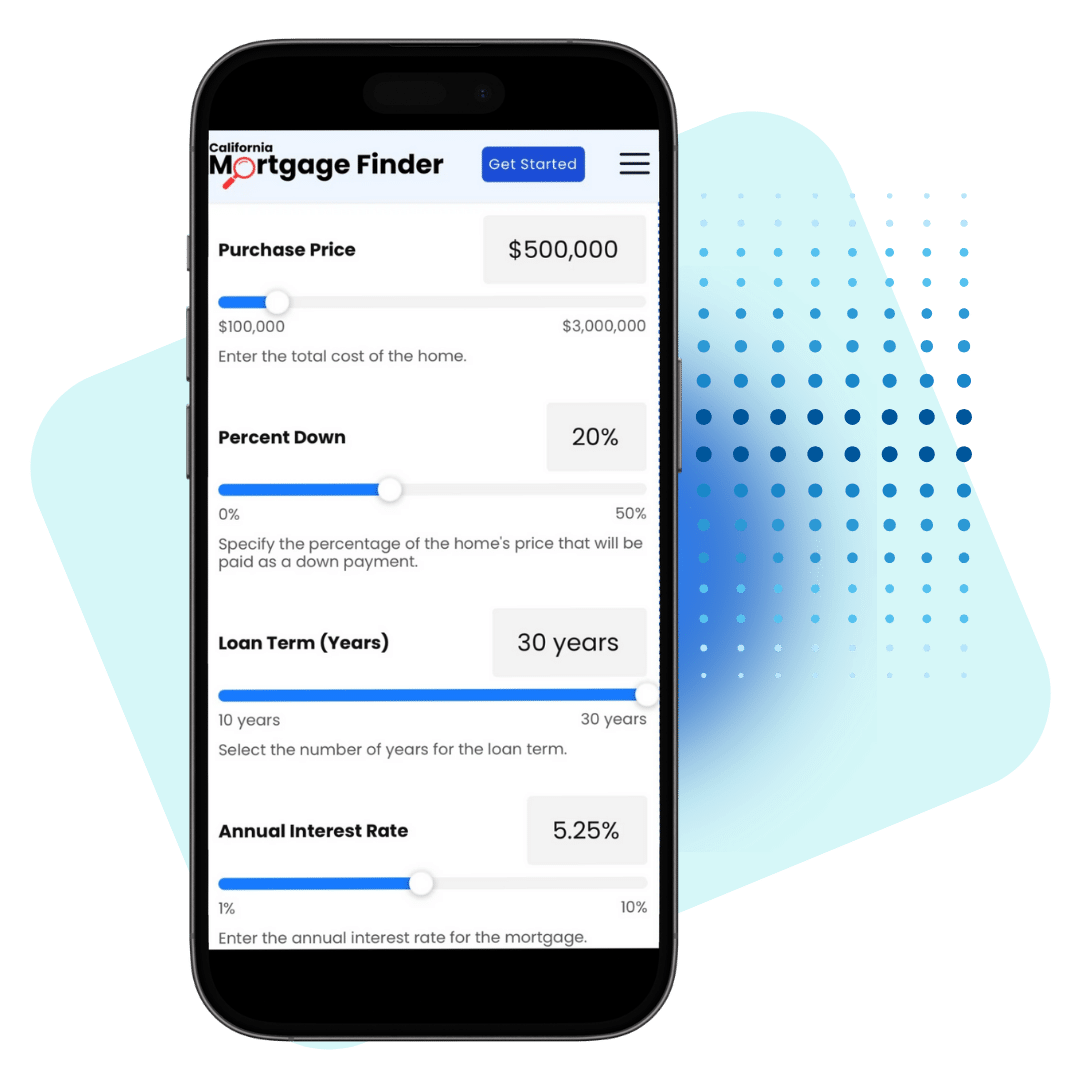

Easy-To-Use Mortgage Calculators

Our mortgage calculators are designed for California buyers and homeowners who want clarity without spreadsheets.

- Estimate monthly payment (principal, interest, taxes, insurance, HOA)

- Compare purchase vs. refinance scenarios side-by-side

- Compare loan programs side-by-side

- Test down payment options and see the payment impact instantly

- Estimate cash-to-close and upfront costs

- Get a quick sense of affordability before starting pre-approval

Informative and educational purposes. Estimates reflect common California factors such as county taxes, insurance, and HOA fees; final numbers depend on pricing and your profile.

Mortgage Calculators

See What California Homeowners and Homebuyers Are Saying

Loan Officer Kevin O’Connor (NMLS #247447 and California DRE #01499872) works in association with JB Mortgage Capital, Inc. (DRE #1836772 and NMLS #238036), an “A+” rated mortgage broker with the Better Business Bureau and “AAA” rated with the Business Consumers Alliance.

“This is the third time I have worked with Kevin. Each experience has been excellent. Kevin will get you the best rate available and take the time to explain every step of the process. He is very straightforward with his approach and responsive.”

“Kevin is honest, trustworthy, and operates with a high sense of urgency. In all of our home purchases across multiple states, Kevin has been the best to work with on all the loans we have secured. I recommend him without reservation.”

Exceptional service and professionalism. Kevin is extremely knowledgeable and straightforward throughout the process. The closing process was very organized and fast, and the rate was very competitive. I find him a very helpful person. I highly recommend him!

“Kevin did everything he said he would do, met every deadline and is a great communicator. I would highly recommend using him and I know we will use him continuously.”

“Kevin O’Connor is as fine a person as I have ever engaged in any business dealing. He is honest, straightforward, kind, patient, and helpful; so helpful, in fact, that through two refi’s, he helped save us over 25% on our monthly mortgage. Can’t recommend him highly enough. A true professional, through and through.”

“We’ve refinanced our loan two times through Kevin and each time he was honest, fast, a great communicator, and gave us a better rate than anyone else quoted. Kevin will be the person we will go to if we ever decide to sell our house or refinance again!”

“We have refinanced 2 properties with Kevin within the last year, and in each transaction, he was always on top of the situation. He was responsive when we had questions and explained the process very well. We would highly recommend using Kevin for any of your mortgage loan needs.”

“I have refinanced several times over the years. My refi with Kevin O’Connor was the easiest ever. He answered every question I had quickly. I did my homework and checked rates etc. first. Kevin had the best rates as well as outstanding service. I highly recommend Kevin. He is very professional.”

“I am pleased to recommend Kevin and share my positive experience. The process was easy and resulted in significant monthly savings. Everything was done remotely, which was so convenient for my busy schedule. He stays in contact every year around the holidays, and would definitely work with Kevin again.”

Kevin provided us with the most competitive rates, prices, and closing time frames. He made the process incredibly easy and straightforward. Kevin answered all of our questions promptly and was always on top of everything. We would definitely recommend Kevin for any mortgage needs you may have. We look forward to working with him again!

“Several times I have used Kevin to refinance my loans and never have been disappointed. He’s constantly a professional, on the ball and very quick to answer my questions. Most of the time I don’t even think about the refinance process as Kevin is completely on top of things taking the worry and work off my plate.”

I closed a refinance of my principle residence with Kevin O’Connor. I have to say that it was probably the most efficient and quick closing that I have experienced among the many mortgage transactions that I have completed in the past. Kevin’s personalized service is what makes the difference.

“As first-time buyers, we had MANY questions throughout the process. Kevin was always incredibly helpful and patient with explaining details. We had a bit of a time crunch and Kevin took care of having everything done on time. We are so grateful for his services and highly recommend him to everyone!”

“I’d like to thank Kevin for providing a great experience for a prospective first-time homebuyer. As a self-employed person, I’ve faced some challenges with applying for a home loan from the traditional big banks. On our phone call, Kevin was very kind and took the time to listen to my specific situation and challenges. Thanks again Kevin!”

California Mortgage Finder

Client satisfaction guides everything we do. See what homebuyers and homeowners are saying about Loan Officer Kevin O’Connor, the California Mortgage Finder.

The Learning Post

Most mortgage stress comes from not knowing what matters and what doesn’t. The Learning Post is where we break down the California mortgage process in plain English, so you can make decisions with confidence.

What you’ll learn here:

- How pre-approval works (and what underwriters actually verify)

- Which loan programs fit different credit scores and down payments

- How to compare rate vs. payment vs. total cost over time

- What impacts approvals: income, assets, debt ratios, property type, and documentation

- Common mistakes that delay closings and how to avoid them

2026 California Conforming Loan Limits

Ready To Start Your California Mortgage Plan?

Get a custom rate quote, then I’ll confirm the best program and next steps.

California Mortgage Finder

Low Rates, Fast Closings and Exceptional Service.