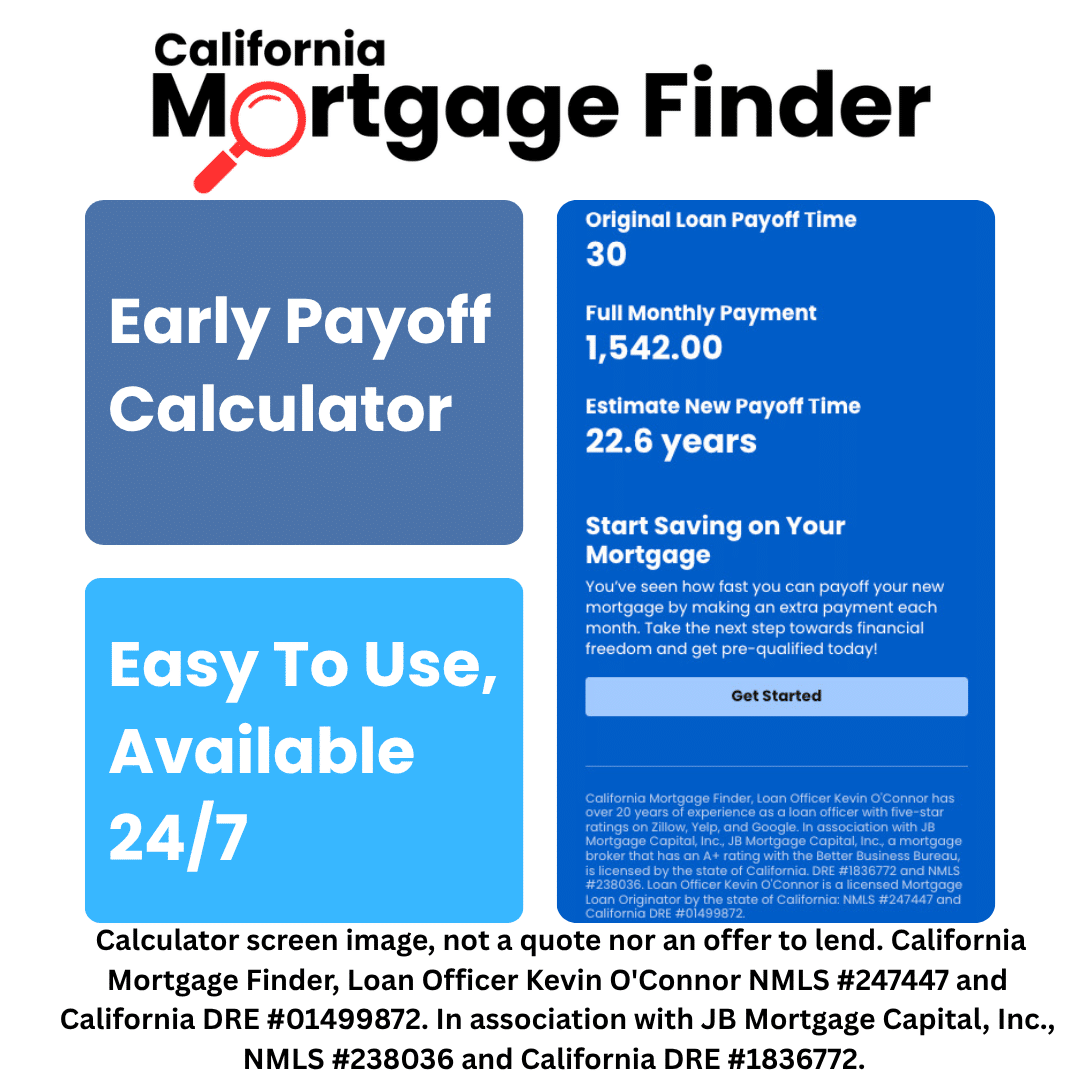

Early Payoff Calculator

The California Mortgage Finder Early Payoff Mortgage Calculator can help you plan an early payoff of your mortgage.

Payoff Your Home Faster

Everyone wants to know how fast they can pay off their current mortgage if they pay a little extra monthly. Our Early Payoff Mortgage Calculator can help you do that; it only takes a few seconds! Just enter an amount you can pay extra each month (this amount goes directly to your principal balance), and you’ll see how fast you can payoff your mortgage.

CMF Mortgage Calculator Disclosure

California Mortgage Finder’s calculators are for illustrative and informational purposes. They are not tax, investment, or financial advice. They do not provide quotes, and they are not a lending guarantee. Please consult with a licensed and qualified professional before making any decisions. If you want to explore the rates and costs of buying a home, please get in touch with us directly to discuss.

California Mortgage Finder

We’re the ideal partner for your next mortgage transaction.

Early Payoff And Things You Should Know

If I Start Paying Extra, Can I Stop Doing That Anytime I Want?

Yes, you are not required to pay extra even if you’ve been doing that for a while. It’s always optional.

Will The Lender Recast My Mortgage If I Pay Extra?

Possibly. If you pay a little extra monthly, the lender will not recast your mortgage. If you make a significant one-time payment, you can ask the lender to recast your mortgage (recasting is not guaranteed).

Are There Fees For An Early Payoff?

No, there are no fees associated with an early payoff of a mortgage.

Is An Early Payoff Option Available On A 15-year Fixed Rate Mortgage?

Yes. You can also early payoff a 25, 20, and 10-year fixed-rate mortgage.

Do I Need To Let The Lender Know I Want To Pay Extra Each Month?

Generally, no. On your mortgage statement coupon, you should have the option to list an extra payment toward your principal balance.

California Mortgage Finder Articles

Never stop learning.

Your Credit Report And Debt Collection Rights

When you apply for credit, businesses inspect your credit history to determine if you meet their requirements for extending credit. The Fair Credit Reporting Act…

First Time Home Buyer

Buying a home for the first time can be overwhelming. However, as a California first-time homebuyer, you have access to resources that will make the…

Choosing The Right Mortgage

Every situation is unique. Just because one type of mortgage was good for your neighbor or even your parents doesn’t mean it’s the right mortgage…