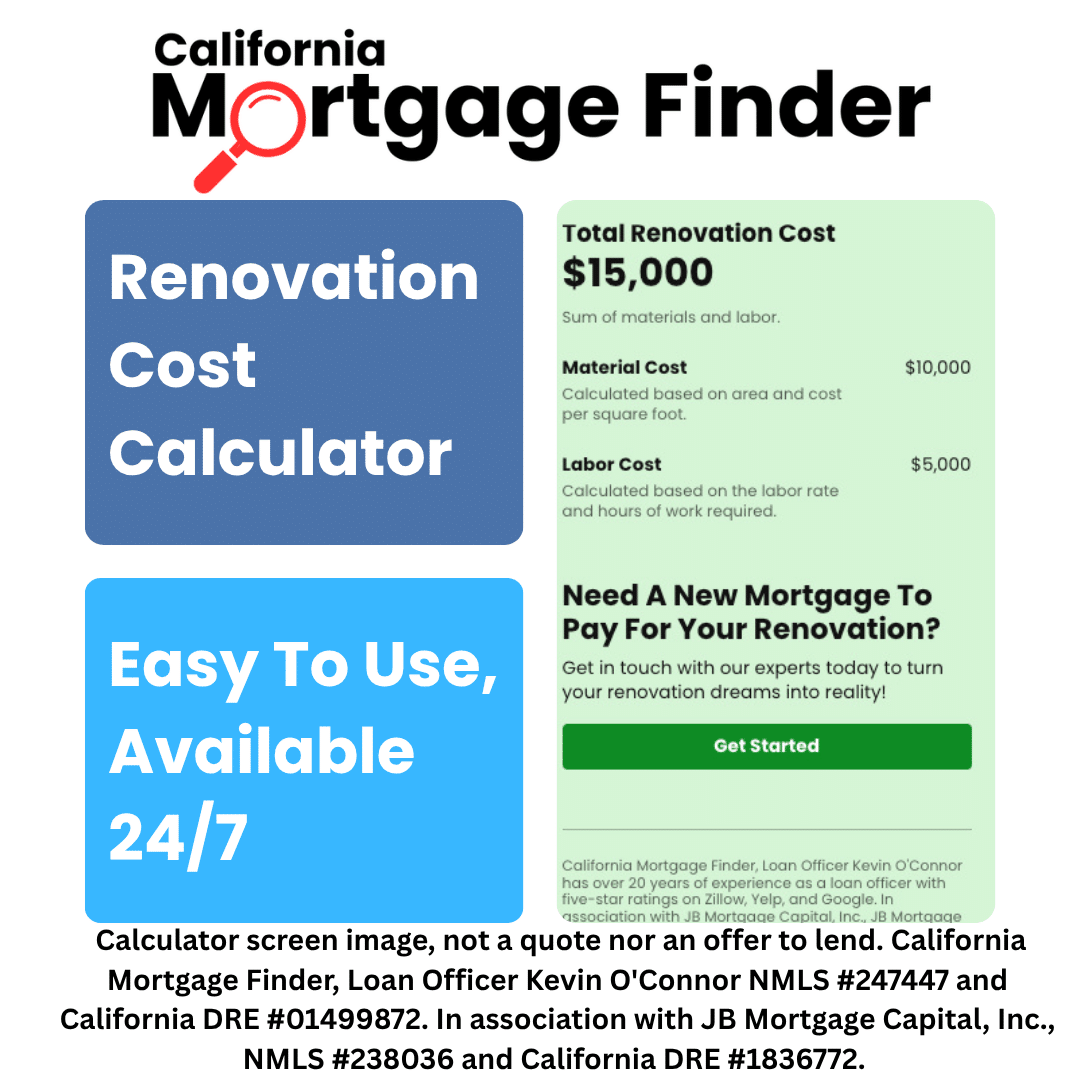

Renovation Cost Calculator

The California Mortgage Finder Renovation Cost Calculator can help you determine the costs associated with a renovation.

How Much Will That Cost?

Our Renovation Cost Calculator can show you how much a renovation might cost. The estimate will give you an idea of what you need to make that renovation happen, and if you need a mortgage to get it to the finish line, we can help with that..

CMF Mortgage Calculator Disclosure

California Mortgage Finder’s calculators are for illustrative and informational purposes. They are not tax, investment, or financial advice. They do not provide quotes, and they are not a lending guarantee. Please consult with a licensed and qualified professional before making any decisions. If you want to explore the rates and costs of buying a home, please get in touch with us directly to discuss.

California Mortgage Finder

We’re the ideal partner for your next mortgage transaction.

Things You Should Know About Doing A Renovation

Do You Offer Renovation Mortgages?

Yes, we do. Check out our Renovation Mortgage page for additional details.

What Are Renovation Mortgage Rates The Same As Non-Renovation Mortgage Rates?

They are not, and generally speaking, they are 1% to 3% higher than regular non-renovation mortgage rates. Why? Because a renovation mortgage carries higher risk than a non-renovation mortgage, lenders charge higher rates to offset that risk.

Can I Buy A House With A Renovation Mortgage?

Yes, our Renovation Mortgage program is open to both homeowners and homebuyers.

How Long Does It Take To Close A Renovation Mortgage?

This is a difficult question to answer because every renovation is different and has different variables (e.g., permits, etc.). Generally speaking, if everything is in order, it takes 45-60 days to close most loans. Some clients can close in 30 days. However, that is not the norm.

Can I Refinance A Renovation Mortgage?

Once the renovation is done and complete, you can refinance the mortgage without restriction.

California Mortgage Finder Articles

Never stop learning.

Your Credit Report And Debt Collection Rights

When you apply for credit, businesses inspect your credit history to determine if you meet their requirements for extending credit. The Fair Credit Reporting Act…

Choosing The Right Mortgage

Every situation is unique. Just because one type of mortgage was good for your neighbor or even your parents doesn’t mean it’s the right mortgage…

The Right Time To Refinance

Refinancing your home can help you achieve your financial goals. These goals may include better monthly cash flow, home improvement projects that increase the home’s…