2026 California Conforming Loan Limits

Jump To: Loan Limits By County | Loan Limits Since 2015 | Underwriting Requirements |

2026 California Conforming Loan Limit

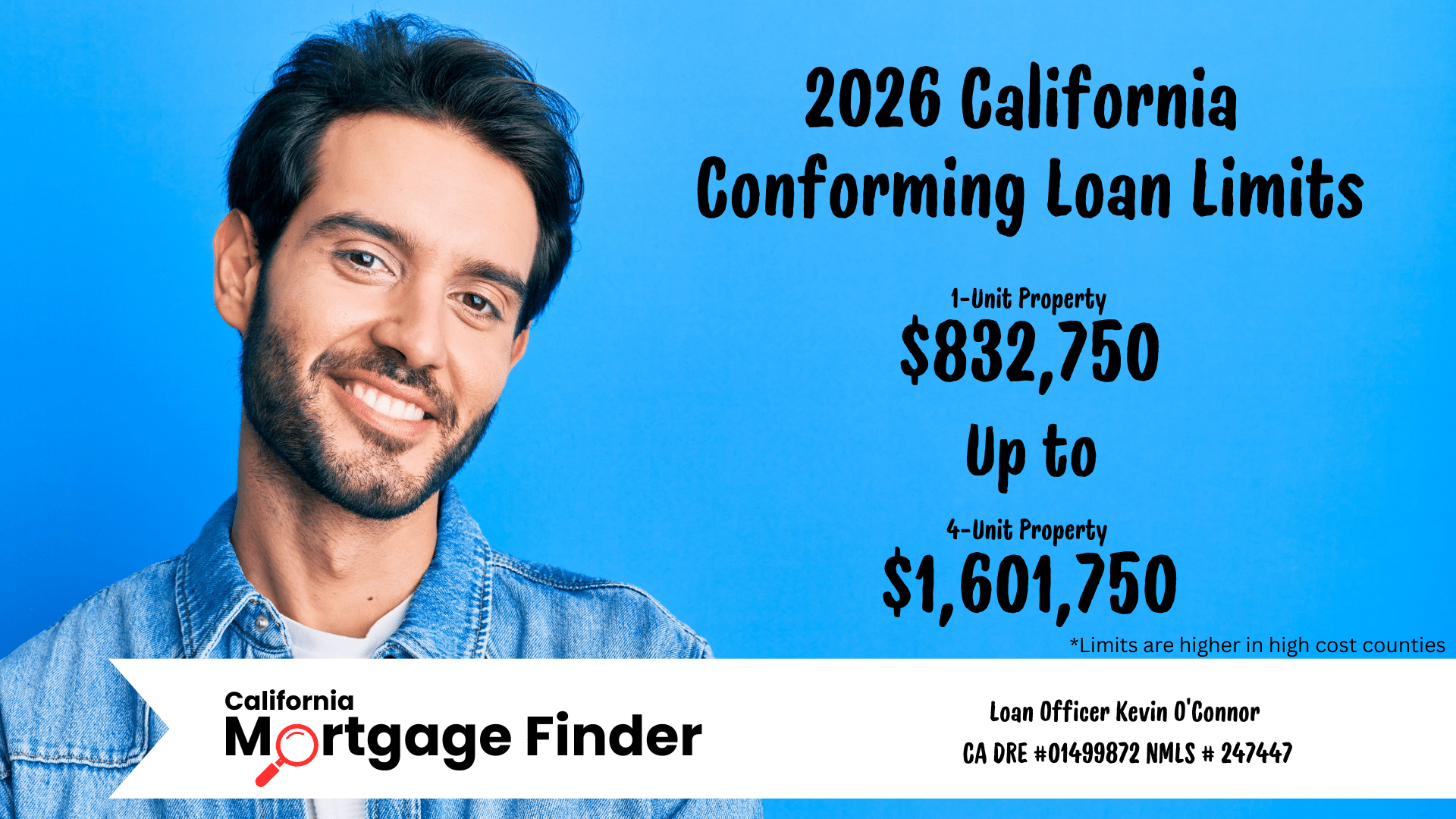

The Federal Housing Finance Agency (FHFA) has set the 2026 California conforming loan limit at $832,750 and up to $1,249,125 (1-unit property) in high-cost areas (e.g., Los Angeles County). The Federal Housing Finance Agency (FHFA) updates the California conforming loan limits annually.

What Is A Conforming Loan?

A conforming loan is a conventional home loan that “conforms” to the loan limits established by the Federal Housing Finance Agency and the underwriting guidelines of Fannie Mae and Freddie Mac.

Loan Limits By California County

Here are the 2026 California conforming loan limits for all 58 counties.

| County | 1-Unit | 2-Unit | 3-Unit | 4-Unit |

|---|---|---|---|---|

| ALAMEDA | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| ALPINE | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| AMADOR | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| BUTTE | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| CALAVERAS | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| COLUSA | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| CONTRA COSTA | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| DEL NORTE | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| EL DORADO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| FRESNO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| GLENN | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| HUMBOLDT | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| IMPERIAL | $832,750 | $1,032,650 | $1,288,800 | $1,601,750 |

| INYO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| KERN | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| KINGS | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| LAKE | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| LASSEN | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| LOS ANGELES | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| MADERA | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| MARIN | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| MARIPOSA | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| MENDOCINO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| MERCED | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| MODOC | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| MONO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| MONTEREY | $994,750 | $1,273,450 | $1,539,350 | $1,913,000 |

| NAPA | $1,017,750 | $1,302,900 | $1,574,900 | $1,957,250 |

| NEVADA | $832,750 | $1,066,250 | $1,288,800 | $1,551,250 |

| ORANGE | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| PLACER | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| PLUMAS | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| RIVERSIDE | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SACRAMENTO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SAN BENITO | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| SAN BERNARDINO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SAN DIEGO | $1,104,000 | $1,413,350 | $1,708,400 | $2,1,23,100 |

| SAN FRANCISCO | $1,249,125 | $1,599,375 | $1,872,225 | $2,402,625 |

| SAN JOAQUIN | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SAN LUIS OBISPO | $1,000,500 | $1,280,850 | $1,548,250 | $1,924,100 |

| SAN MATEO | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| SANTA BARBARA | $941,850 | $1,205,750 | $1,457,450 | $1,811,300 |

| SANTA CLARA | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| SANTA CRUZ | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| SHASTA | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SIERRA | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SISKIYOU | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SOLANO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SONOMA | $897,000 | $1,148,350 | $1,388,050 | $1,725,050 |

| STANISLAUS | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| SUTTER | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| TEHAMA | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| TRINITY | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| TULARE | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| TUOLUMNE | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| VENTURA | $1,035,000 | $1,325,000 | $1,601,600 | $1,990,450 |

| YOLO | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| YUBA | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

High-Cost Areas In California

In some California counties where the local median home value is 115% higher than the regular conforming loan limit, FHFA has designated these counties as “high-cost areas.” The Housing and Economic Recovery Act (HERA) sets a higher loan limit for these areas based on the local home values, but it can’t go higher than 150% of the regular California conforming loan limit. The new maximum conforming loan limit for single-unit homes in California high-cost areas $1,249,125, which is 150% of $832,750.

Previously Announced California Conforming Loan Limits Since 2015

The Federal Housing Finance Agency updates its California conforming loan limits annually. Here are the previously announced California conforming loan limits since 2015:

2015

The California conforming loan limit in 2015 was $417,000; in some high-cost counties, like Los Angeles County, it was as high as $615,250.

2016

The California conforming loan limit in 2016 was $417,000 (the same as in 2015), and in some high-cost counties, like San Francisco County, it was as high as $625,500.

2017

The California conforming loan limit in 2017 was $424,100; in some high-cost counties, like Alameda County, it was as high as $636,150.

2018

The California conforming loan limit in 2018 was $453,100; in some high-cost counties, like Orange County, it was as high as $679,650.

2019

The California Conforming Loan limit in 2019 was $483,350; in some high-cost counties, like Santa Clara County, it was as high as $726,525.

2020

The California conforming loan Limit in 2020 was $510,400, and in some high-cost counties, like San Mateo County, it was as high as $765,600.

2021

The California conforming loan Limit in 2021 was $548,250. In some high-cost counties, like Santa Cruz County, it was as high as $822,375.

2022

The California conforming loan limit in 2022 was $647,200 for most counties, and in some high-cost counties, like Marin County, it was as high as $970,800.

2023

The 2023 California conforming loan limit was $726,200 for most counties, and in some high-cost counties, like Contra-Costa County, it was as high as $1,089,300.

2024

The 2024 California conforming loan limit was $766,550 for most counties, and in some high-cost counties, like Los Angeles, it was as high as $1,149,825.

2025

The 2025 California conforming loan limit was $806,500 for most counties, and in some high-cost counties, like San Francisco County, it was as high as $1,209,750.

Conforming Loan Underwriting Requirements

The baseline conforming loan underwriting requirements are found in Fannie Mae’s “Selling Guide.” The guide is over 1,100 pages, so I’ll touch on the most essential areas you should be aware of as of January 1, 2024:

- The loan amount must conform to the preset lending limits.

- Conforming loan underwriting requirements allow for primary, secondary, and non-owner occupied properties (provided they are one to four units).

- Single-Family Residences, Condominiums, Townhomes, Multi-Unit, and Manufactured homes are all eligible.

- The minimum down payment for a purchase is 3.00% (which results in a loan-to-value ratio of 97%), and the minimum amount of equity in a home for a refinance is 3.00%.

- Generally speaking, you need a credit score above 620 to obtain a conforming loan. Qualifying for scores below 700 becomes more difficult as you move further down.

- The debt-to-income ratio should be 50% or lower.

- Most conforming loans do not need liquid asset reserves; however, some do. You’ll need to show some liquid reserves if purchasing or refinancing a rental property. If you have a low credit score, a debt-to-income ratio above 45%, and are taking cash out, you’ll need to show some liquid reserves.

For a more in-depth understanding of the general conforming loan underwriting requirements, contact us directly so we can answer any questions you may have.

Is A Conforming Loan Right For You?

If your loan amount is within the preset conforming loan limits for your county, your credit score is above 700, and your debt-to-income ratio is below 50%, then a conforming loan might be right for you even if you only have 3% down (or 3% equity if you’re refinancing).

Conforming loans offer some of the best mortgage rates, and for those with less than 20% down (or equity), you’ll have a lower Mortgage Insurance (MI) cost.

In addition to the lower MI cost, you’ll be able to get rid of the MI, which is permanent on an FHA loan.