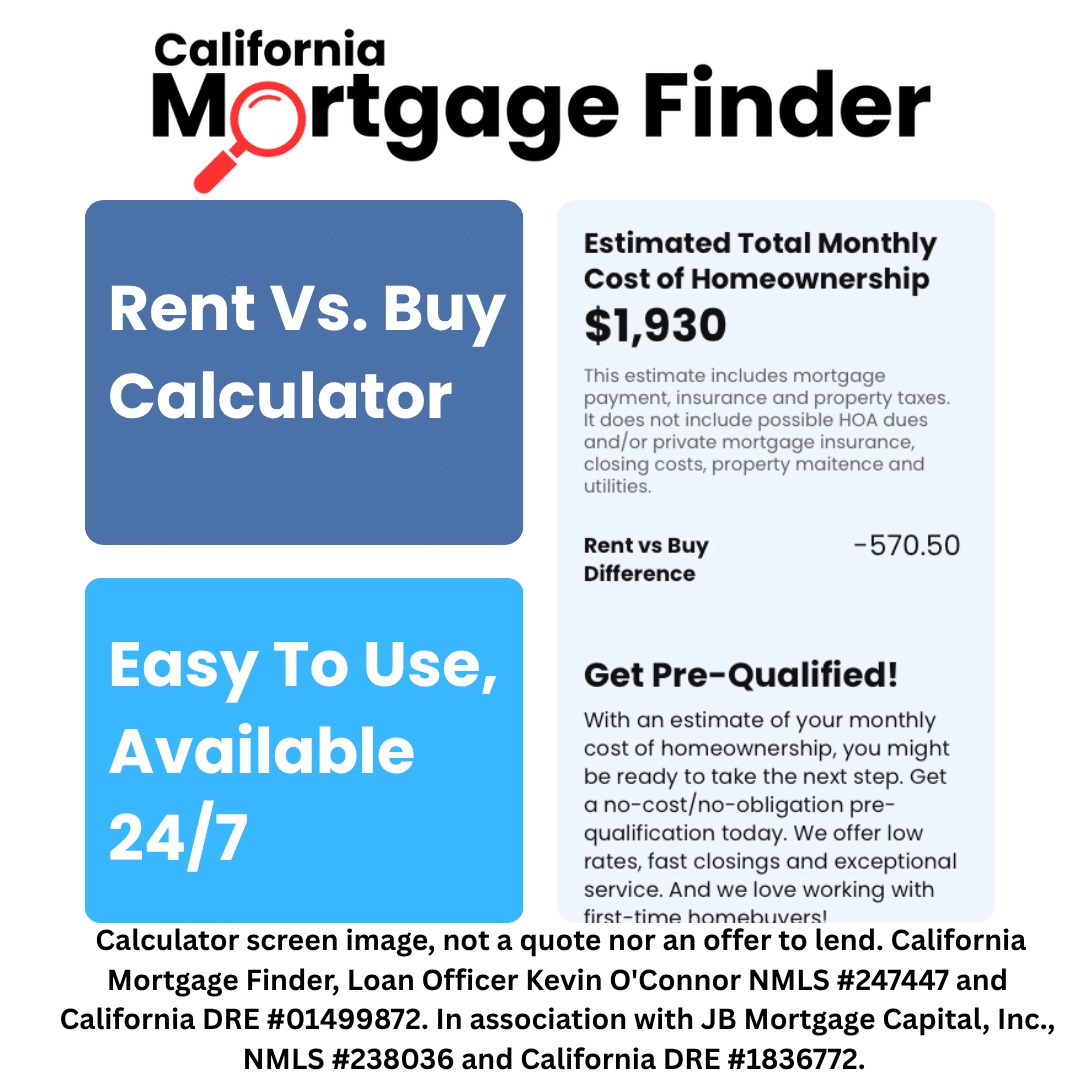

Rent Vs. Buy Calculator

The California Mortgage Finder Rent vs. Buy Calculator shows the cost difference between renting and buying a home.

Big Decisions Made Easy

Our Rent vs. Buy Calculator is our number calculator among first-time homebuyers. A powerful tool, yet simple and easy to use. Some say it helps make the big decision of rent vs. buy easy. In seconds, you can get the detailed information you need to decide between renting or buying.

CMF Mortgage Calculator Disclosure

California Mortgage Finder’s calculators are for illustrative and informational purposes. They are not tax, investment, or financial advice. They do not provide quotes, and they are not a lending guarantee. Please consult with a licensed and qualified professional before making any decisions. If you want to explore the rates and costs of buying a home, please get in touch with us directly to discuss.

California Mortgage Finder

We’re the ideal partner for your next mortgage transaction.

Rent Vs. Buy And Things You Should Know

What Are Some Costs Associated With Owning A Home I Should Be Aware Of?

As a homeowner, you pay for everything associated with your new home. Everything from utilities to anything that breaks. It’s impossible to estimate what that might look like, but when it comes to repairs, you should always have an emergency fund to get things fixed.

What Are The Tax Benefits A Homeowner Gets?

The best thing to do is to ask a tax professional. There are numerous tax benefits to owning a home; however, there are a lot of variables involved, and the best person to discuss this with is a tax professional.

Can I Buy A Home With My Roommate?

Sure, not a problem.

Do I Need A Down Payment?

Yes, usually. In some cases, loan applicants can buy a home without a down payment. However, most people have to put at least 3.00% down (that’s 3.00% of the purchase price).

Are There Special First-Time Homebuyer Programs?

We have loan programs designed to help first-time homebuyers. They offer easy qualification and low down payment options.

California Mortgage Finder Articles

Never stop learning.

Your Credit Report And Debt Collection Rights

When you apply for credit, businesses inspect your credit history to determine if you meet their requirements for extending credit. The Fair Credit Reporting Act…

Choosing The Right Mortgage

Every situation is unique. Just because one type of mortgage was good for your neighbor or even your parents doesn’t mean it’s the right mortgage…

Credit Report Tips

If you’re buying a home or refinancing your current mortgage, an underwriter will review your credit report to determine if you meet the baseline underwriting…