Early Payoff Calculator

payoff your home early

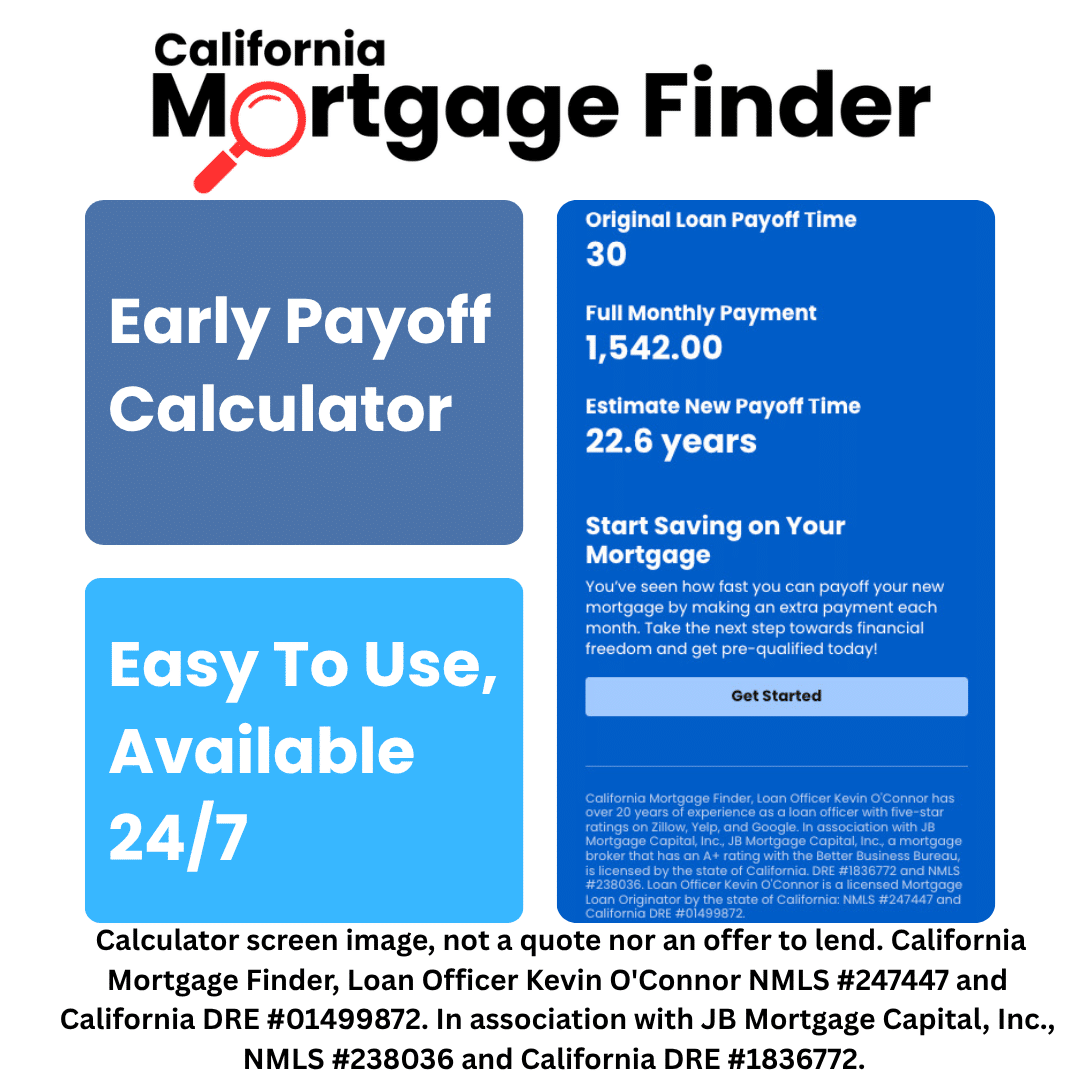

The California Mortgage Finder early payoff calculator helps homeowners estimate how making extra payments may reduce interest costs and shorten the life of a mortgage.

By entering your loan details and adding extra monthly or periodic payments, you can see how much faster your loan could be paid off and how much interest you may save over time.

This calculator is designed for homeowners who want to explore strategies for paying off their mortgage early without refinancing.

Questions? Contact KevinEarly Mortgage Payoff Calculator

Compare standard payoff vs accelerated payments (monthly/biweekly + optional lump sum) to see time and interest savings.

How This Calculator Works

Key data inputs used

This early mortgage payoff calculator estimates accelerated payoff scenarios using standard mortgage formulas and the following inputs:

- Current Loan Balance – Remaining mortgage balance

- Interest Rate – Current mortgage interest rate

- Loan Term Remaining – Time left on the mortgage

- Regular Monthly Payment – Current scheduled payment

- Extra Monthly Payment – Additional amount applied to principal

- VA Funding Fee – One-time VA-required fee, typically financed into the loan

- One-Time Extra Payment (Optional) – Lump-sum principal payment

- Payment Frequency (Optional) – Monthly or bi-weekly options

Results update automatically as inputs change, allowing you to compare different payoff strategies.

Understanding Your Results

What the early payoff calculator results mean

After entering your information, the calculator provides estimates for:

- New Payoff Date – How much sooner the loan could be paid off

- Interest Saved – Estimated total interest savings

- Total Payments Made – Reduced number of payments over time

- Remaining Balance Over Time – How quickly principal decline

These results show how even modest extra payments may significantly reduce interest costs.

When Should You Use an Early Payoff Calculator?

When this calculator is useful

This early payoff calculator is especially helpful if you are:

- Making extra payments toward your mortgage

- Considering bi-weekly payment strategies

- Deciding whether to pay off a mortgage early or invest elsewhere

- Planning long-term financial goals

- Exploring ways to reduce total interest costs

VA Purchase Scenario

Example: California early payoff estimate

Current loan balance: $520,000

Interest rate: 6.50%

Remaining term: 27 years

Extra monthly payment: $300

Using these inputs, the calculator estimates the mortgage could be paid off approximately 5 years earlier, with interest savings of $126,306. Adjusting the extra payment amount shows how payoff timing changes.

Important Assumptions

What this calculator does not do

This early mortgage payoff calculator provides estimates based on common mortgage assumptions. It does not account for:

- Prepayment penalties (if applicable)

- Opportunity cost of investing extra funds

- Changes in income or expenses

- Refinancing into a new loan

- Tax implications of interest deductions

Actual savings depend on loan terms and individual financial circumstances.

Frequently Asked Questions

Early payoff calculator FAQs

Does this calculator assume a prepayment penalty?

No. It assumes extra payments can be applied without penalty.

Is a bi-weekly payment better than extra monthly payments?

Both strategies can reduce interest. This calculator helps compare options.

Is paying off a mortgage early always the best choice?

Not necessarily. It depends on interest rates, investment alternatives, and financial goals.

Do I need to let the lender know I want to pay extra?

Generally, no. On your mortgage statement coupon, you should have the option to list an extra payment toward your principal balance.

Is this calculator specific to California?

Yes. It uses common California mortgage assumptions, though loan terms vary by lender.

How accurate are the results?

Results are estimates intended for planning and comparison purposes only.

California Mortgage Finder

Low Rates, Fast Closings and Exceptional Service.

Related Mortgage Calculators

Additional mortgage tools on California Mortgage Finder

FHA Mortgage Calculator

VA Mortgage Calculator

Purchase Mortgage Calculator

California Mortgage Finder Articles

Your Credit Report And Debt Collection Rights

When you apply for credit, businesses inspect your credit history to determine if you meet their requirements for extending credit. The Fair Credit Reporting Act…

First-Time Homebuyer

Buying a home for the first time can be overwhelming. However, as a California first-time homebuyer, you have access to resources that will make the…

Choosing The Right Mortgage

Every situation is unique. Just because one type of mortgage was good for your neighbor or even your parents doesn’t mean it’s the right mortgage…