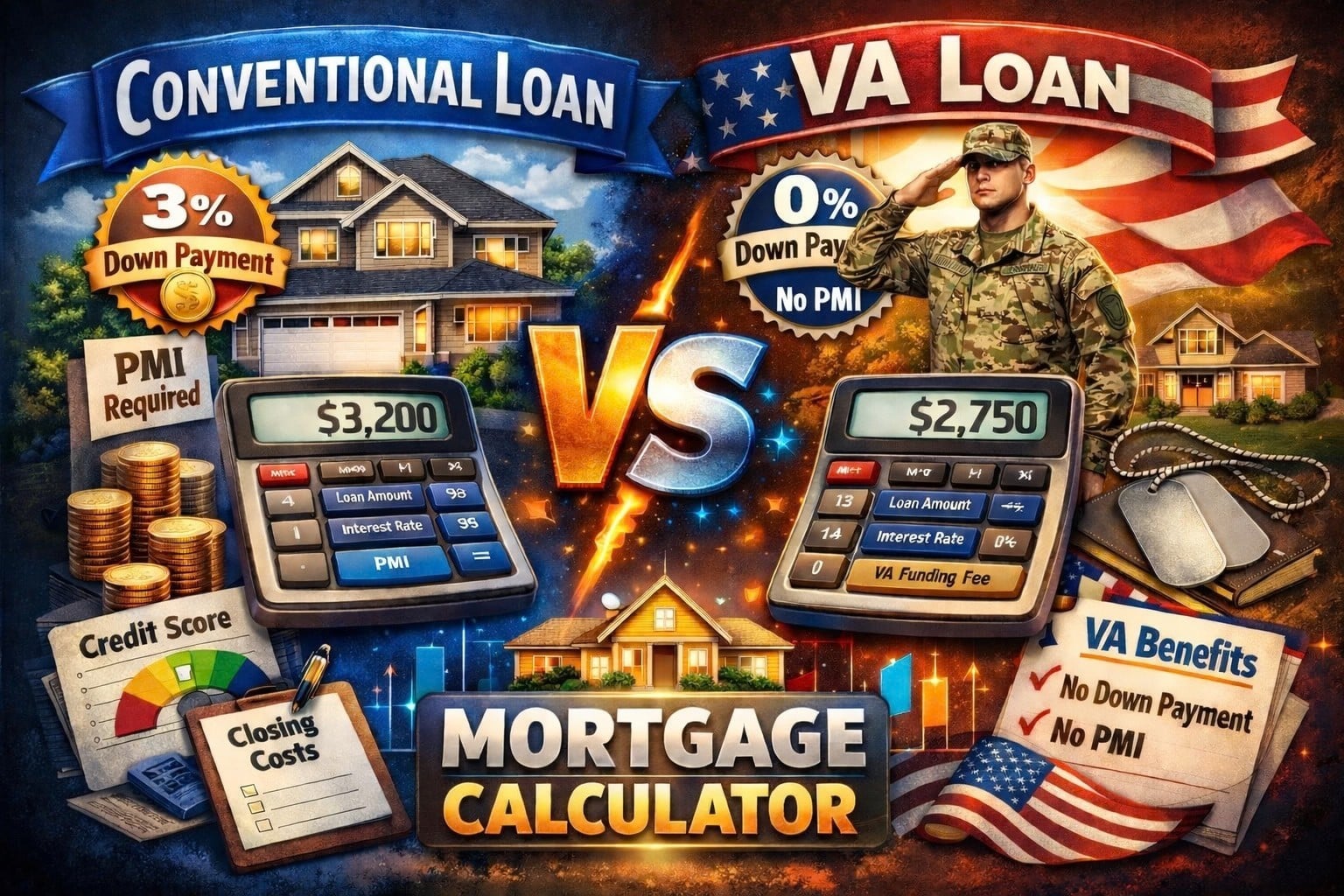

Conventional vs. VA Calculator

Explore your options

California Mortgage Finder’s conventional vs VA mortgage calculator helps VA-eligible borrowers compare conventional and VA loan options for both home purchases and refinances.

Using the toggle above the calculator, you can switch between Purchase and Refinance scenarios to see how monthly payments, mortgage insurance, funding fees, and total costs differ between the two loan programs.

This calculator is designed for veterans, active-duty service members, and eligible surviving spouses who qualify for VA benefits and want to understand whether a conventional or VA loan better fits their current goal.

Questions? Contact KevinInputs

Home and Loan Basics

Conventional Assumptions

PMI estimate: loan x PMI% / 12. Real PMI varies by credit, LTV, and insurer.

VA Assumptions

VA usually has no monthly mortgage insurance. Funding fee is treated as a one-time cost that can be paid in cash or financed.

Results

Conventional breakdown-

| Principal and interest | - |

| PMI | - |

| Property taxes | - |

| Insurance | - |

| HOA | - |

| Total | - |

VA breakdown-

| Principal and interest | - |

| Property taxes | - |

| Insurance | - |

| HOA | - |

| Total | - |

Out-of-pocket comparison Horizon

| Conventional out-of-pocket | - |

| VA out-of-pocket | - |

| Difference | - |

Payment composition

Quick note

How This Calculator Works

Conventional vs VA mortgage calculator inputs explained

This calculator compares conventional and VA loan scenarios for both purchase and refinance situations using standard mortgage formulas and the following inputs:

- Scenario Toggle – Choose between Purchase or Refinance

- Home Price / Home Value – Purchase price or current property value

- Down Payment (Purchase) – Required for conventional loans; optional for VA loans

- Current Loan Balance (Refinance) – Remaining balance on your existing mortgage

- Interest Rate (Conventional) – Estimated conventional loan rate

- Interest Rate (VA) – Estimated VA loan rate

- Loan Term – Commonly 30 years

- PMI (Conventional) – Estimated private mortgage insurance when applicable

- VA Funding Fee – One-time VA-required fee (may be financed or waived)

- Property Taxes – Estimated annual property taxes

- Homeowners Insurance – Estimated annual insurance cost

- HOA Fees (if applicable) – Monthly association dues

Results update automatically as inputs change, allowing you to compare both loan programs in real time.

Understanding Your Results

What the conventional vs. VA mortgage calculator results mean

After entering your information, the calculator provides estimates for both conventional and VA loans, including:

- Monthly Principal & Interest – Base loan payment

- Mortgage Insurance or Funding Fee Impact – PMI for conventional loans vs VA funding fee

- Property Taxes & Insurance – Monthly escrow estimates

- PMI (if applicable) – Private mortgage insurance based on equity

- Total Monthly Payment – Estimated all-in housing cost

VA loans typically do not require monthly mortgage insurance, which can significantly reduce the total monthly payment compared to conventional loans with PMI.

When Should You Use a Conventional vs VA Mortgage Calculator?

When this calculator is useful

This conventional vs VA calculator is especially helpful if you are:

- VA-eligible and deciding between conventional and VA loans

- Buying a home and comparing down payment requirements

- Refinancing and evaluating PMI versus VA funding fees

- Planning to minimize long-term housing costs

- Unsure which loan program best fits your financial profile

Purchase vs Refinance Comparison Scenarios

Example purchase comparison

Home price: $800,000

Down payment: Conventional 5%, VA 0%

Conventional rate: 5.75%

VA rate: 5.25%

Loan term: 30 years

In purchase mode, the calculator shows how VA loans may offer lower monthly payments due to no ongoing mortgage insurance, while conventional loans may require PMI with smaller down payments.

Example refinance comparison

Home value: $800,000

Current loan balance: $610,000

Conventional refinance rate: 5.75%

VA refinance rate: 6.25%

Loan term: 30 years

In refinance mode, the calculator compares payment changes and long-term costs for each loan program based on insurance and fee structures.

Important Assumptions & Limitations

Refinance calculator assumptions

This conventional vs VA calculator provides estimates based on common California assumptions. It does not account for:

- VA eligibility verification or remaining entitlement

- Funding fee exemptions due to service-connected disability

- Credit score or debt-to-income requirements

- Closing costs or prepaid expenses

- County-specific property tax variations

Actual loan eligibility and costs depend on the lender’s underwriting and program guidelines.

Frequently Asked Questions

Conventional vs VA mortgage calculator FAQs

Can someone qualify for both a conventional loan and a VA loan?

Can someone qualify for both a conventional loan and a VA loan?

Why does the VA loan often show a lower monthly payment in comparisons?

VA loans typically do not require monthly mortgage insurance, while conventional loans may require PMI when the down payment or equity is lower. Removing PMI can significantly reduce the monthly payment in many scenarios.

Does the calculator assume the VA funding fee is financed into the loan?

Yes, unless adjusted, the calculator assumes the VA funding fee is financed into the loan amount, which is the most common approach. Borrowers who are exempt from the funding fee can reflect that by adjusting inputs.

Can this calculator help decide whether refinancing into a VA loan makes sense?

Yes. In refinance mode, the calculator helps illustrate how switching from a conventional loan with PMI to a VA loan may affect monthly payments and long-term costs.

Does this calculator account for VA funding fee exemptions?

The calculator allows for adjustments but does not automatically determine exemption eligibility. Veterans with service-connected disabilities may be exempt from the funding fee and should account for that when comparing scenarios.

Why might someone choose a conventional loan even if they are VA-eligible?

Some borrowers prefer conventional loans due to property eligibility, seller preferences, loan structure flexibility, or long-term planning considerations. This calculator focuses on cost comparison, not program recommendations.

Are closing costs included in the results?

No. The calculator focuses on monthly payments and loan structure differences. Closing costs and prepaid items vary by lender and are not included unless modeled separately.

How should this calculator be used with other mortgage calculators?

This tool works best as a comparison step. Once you identify which loan type may be a better fit, use the standalone VA or refinance calculators for deeper, scenario-specific analysis.

California Mortgage Finder

We’re the ideal partner for your next mortgage transaction.

Related Mortgage Calculators

Additional mortgage tools on California Mortgage Finder

FHA vs VA Mortgage Calculator

Conventional vs FHA Mortgage Calculator

California Mortgage Finder Articles

The Right Time To Refinance

Refinancing your home can help you achieve your financial goals. These goals may include better monthly cash flow, home improvement projects that increase the home’s…

Should You Refinance Your Mortgage?

One of the most common questions I receive from homeowners is: Should I refinance my mortgage? Only you, the homeowner, can decide; however, my short…

Ten Tips For Refinancing

For many homeowners, there comes a time when a refinance is in order. For that reason, we’ve created our tips for refinancing a mortgage. There…